Google can not seem to sit nonetheless in the case of its manufacturers and companies. This time, Google Pay (often known as GPay) and Google Wallet are as soon as once more switching locations in keeping with an e-mail despatched to Google Pay customers on Thursday.

In 2011, the corporate made its first enterprise into cellular funds with the Google Wallet app for Android. In some unspecified time in the future, it moved tap-to-pay performance to a brand new app referred to as Android Pay, leaving Google Pockets to deal with solely peer-to-peer funds. In 2018, the 2 companies merged again into an all-in-one app referred to as Google Pay. Issues received complicated once more in 2022 as Google Pockets was reintroduced with Google Pay now serving as a quasi-accounting app and loyalty program tracker in the US. Confused but? Us too.

Come June, although, Google Pay will formally be no extra. Here is what that you must know concerning the imminent disappearance of Google Pay.

What is Google Wallet, how does it work, and which banks support it?

Google Pockets is the corporate’s handy cost system for Android customers, beforehand referred to as Android Pay.

What’s Google Pay?

As of 2022, the Google Pay app, or GPay as you will discover it in your cellphone, solely exists in the US and, of all different locations, Singapore. Within the 40-odd different areas the place Google is concerned in cellular funds, these customers solely get the Google Pockets app.

GPay permits customers to hyperlink their numerous financial institution and credit score accounts to assist them preserve observe of their spending. As well as, GPay additionally acts as a portal for Google-provided money again rewards at numerous nationwide chains in addition to native shops and eating places. Money again rewards accumulate as a devoted stability inside GPay. Customers may also ship cash to or request it from different GPay customers.

What’s occurring to Google Pay?

The corporate notified US Google Pay customers by way of e-mail in late February that the app would shut down on June 4, 2024. Here is what meaning for GPay’s numerous features:

- Beginning February 22, money again offers can’t be activated. Money again offers which have but to be processed will nonetheless be processed.

- Peer-to-peer funds will now not be provided as of June 4.

- You probably have a Google Pay stability, you should utilize the GPay app to switch that cash to a checking account via June 4.

- After June 4, you will nonetheless be capable of use the Google Pay website to switch GPay balances or have a look at your transactions. You might also select to unlink your financial institution accounts.

- When you’ve despatched cash to India and Singapore with the Clever integration on the GPay app, you will not be capable of see transaction data beginning June 4. Your Clever account data and historical past stays intact over at Clever — simply use the Clever web site or app.

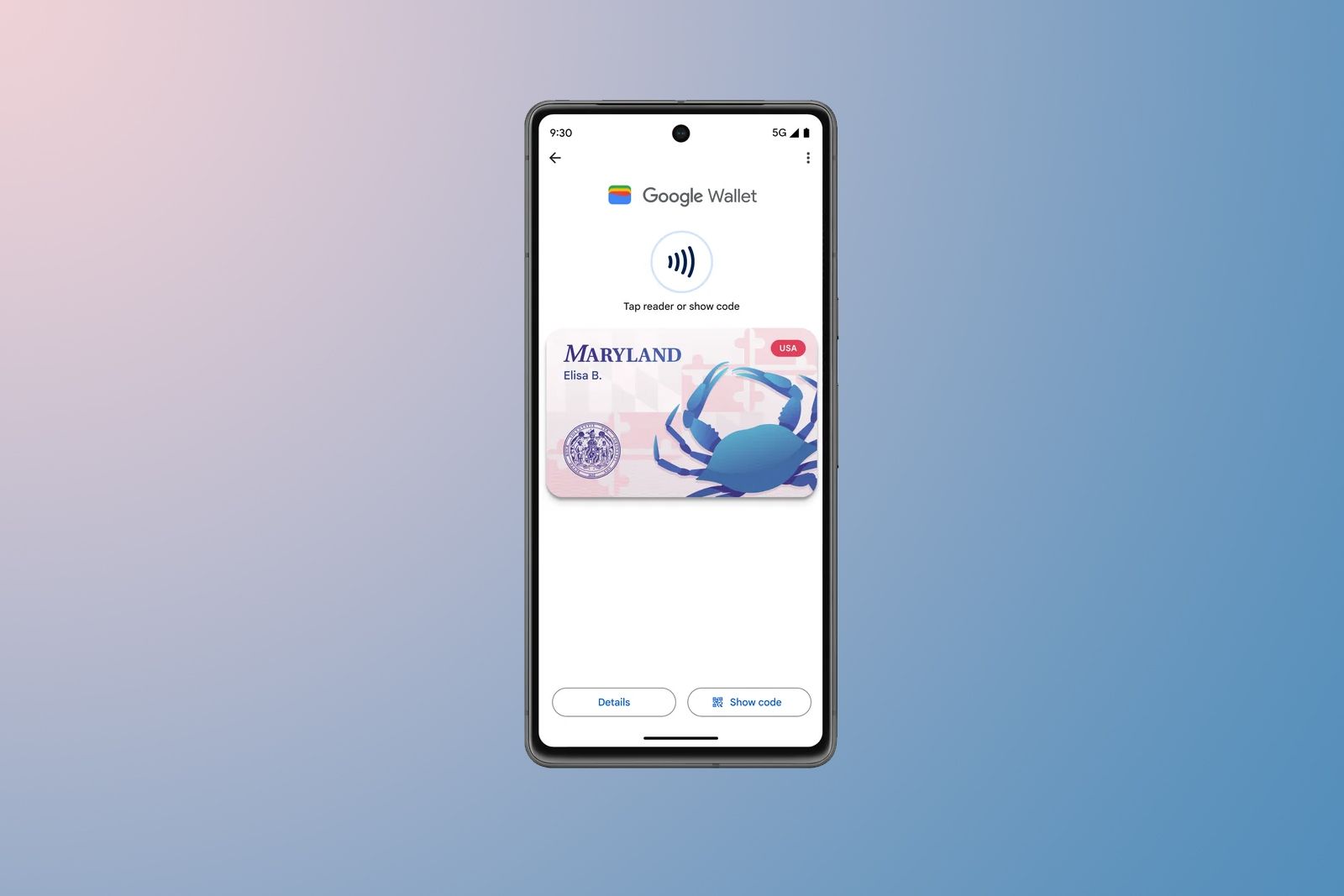

How to easily add your driver’s license, insurance, and ID cards to Google Wallet

Apple Pockets started supporting digital IDs final 12 months. Now, Google Pockets is formally doing the identical. Here is what that you must know and the way it works.

What do I have to do earlier than Google Pay shuts down?

What do I have to do earlier than Google Pay shuts down?

Switch your GPay stability

You probably have a GPay stability, you’ll be able to switch it to a linked checking account. Here is what you do:

- Open the GPay app, then choose the right-hand tab on the underside — this can be your Insights tab.

- Close to the underside of the display, faucet in your Google Pay stability.

- Choose Switch out.

- Sort within the quantity you are transferring. Faucet Subsequent.

- Choose a checking account you have linked to carry out the transaction. Faucet Switch out.

Transferring to a checking account takes longer than it does to a debit card, however you will pay for a speeider switch as debit transfers incur a 1.5% charge with a minimal of $0.31.

You probably have a GPay stability of beneath $1, you will want to prime it off with a minimal of $10 earlier than transferring the stability out.

- Open the Insights tab in GPay and faucet in your Google Pay stability

- Choose +Add cash.

- Sort within the quantity you are transferring. Faucet Subsequent.

- Choose a checking account you have linked to carry out the transaction. Faucet Add.

Take away financial institution and credit score accounts

When you’re trying to take away cost accounts from GPay, this is how you can do it:

- Within the GPay app, faucet in your Google account avatar within the top-right nook.

- Choose Linked accounts & cost strategies.

- Choose an account you’d wish to take away.

- Faucet on the three-dot icon within the top-right nook and press Take away account. When requested to substantiate, choose Sure, take away.

Once more, you do not have to unlink your accounts from Google Pay, nevertheless it’s in all probability a good suggestion to sanitize any pointless information from the platforms you will not be utilizing.

What about Google Pockets?

What about Google Pockets?

Google Pockets is the corporate’s primary app for tap-to-pay transactions. You may additionally be capable of retailer passes, loyalty playing cards, digital IDs, and extra. Sadly, you will not be capable of do a lot of what GPay used to do, so you will in all probability must migrate over to different apps to exchange any misplaced performance.

Trending Merchandise

Cooler Master MasterBox Q300L Micro-ATX Tower with Magnetic Design Dust Filter, Transparent Acrylic Side Panel…

ASUS TUF Gaming GT301 ZAKU II Edition ATX mid-Tower Compact case with Tempered Glass Side Panel, Honeycomb Front Panel…

ASUS TUF Gaming GT501 Mid-Tower Computer Case for up to EATX Motherboards with USB 3.0 Front Panel Cases GT501/GRY/WITH…

be quiet! Pure Base 500DX Black, Mid Tower ATX case, ARGB, 3 pre-installed Pure Wings 2, BGW37, tempered glass window

ASUS ROG Strix Helios GX601 White Edition RGB Mid-Tower Computer Case for ATX/EATX Motherboards with tempered glass…